Bad bookkeeping can have a devastating impact on a business. It can lead to a variety of problems, ranging from financial loss to legal issues. In this article, we will discuss the reasons why bad bookkeeping is dangerous and why you should avoid it.

It is essential for businesses, no matter its size, to keep accurate and up-to-date records of its financial transactions. This will help its owners and management make informed decisions and help ensure the success of the business.

Poor bookkeeping practices can result in several problems that can negatively affect the business’ future.

Bad bookkeeping can cause is financial mismanagement.

When books aren’t kept in an organised manner, it can be difficult to accurately track the business’ cash flow. This can lead to improper decision-making, as business owners may base their choices on incorrect or incomplete financial information.

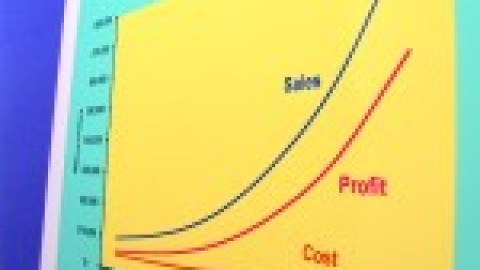

For example, if a business does not keep accurate records of its income and expenses, it may be unable to determine its profit margin.

An owner may believe their business is making a profit when in reality, they are losing money. This can lead to poor business decisions, such as overspending on expenses that should have been avoided.

This mismanagement of finances can result in serious financial difficulties and, in some cases, bankruptcy.

Bad bookkeeping can make it difficult to accurately file taxes.

Tax season can be a stressful time for business owners. Having inaccurate financial records can make the process even more difficult.

Poor bookkeeping practices can result in being unable to claim legitimate deductions. Consequently, this may increase the amount of taxes owed, and lead to an audit. This can be time-consuming and costly and might result in significant fines and penalties. Or even imprisonment.

Businesses unable to accurately file their taxes are face a higher risk of being audited. Further, if a business does not keep accurate employee records, it may face legal action for violating employment laws.

RELATED ARTICLE: 5 Key Accounting Errors Small Business Owners Make

Bad bookkeeping can make it difficult for businesses to secure loans and other forms of financing.

When financial records aren’t kept properly, it can be difficult to demonstrate to lenders the business is financially stable or capable of repaying the loan.

Lenders may hesitate to approve a loan to a business that doesn’t have accurate financial records, as this can indicate the business is not well managed. Consequently, the business may miss out on opportunities to grow and expand.

Poor bookkeeping practices can result in problems with cash flow management.

Accurate, up-to-date financial records are essential for managing cash flow effectively.

When financial records aren’t kept properly, it can be difficult to determine how much money is available to cover expenses, leading to cash flow problems.

This can be especially problematic for small businesses, which may not have resources to survive prolonged periods of cash flow problems.

Bad bookkeeping can damage the business’ reputation.

Business owners must be seen as responsible and trustworthy to attract and retain customers. Poor bookkeeping practices can indicate a business is not well-managed, which can lead to a loss of confidence and trust among customers. This can result in a decrease in sales and lost revenue.

Bad bookkeeping can result in a lack of accountability within the business.

Accurate financial records are essential for tracking a business’ progress and for ensuring everyone is held accountable for their actions.

When financial records aren’t kept properly, it can be difficult to determine who is responsible for certain decisions and actions. This lack of accountability can result in a lack of trust and cooperation within the business, which can harm the business’ success.

Bad bookkeeping increases the risk of fraud and embezzlement.

A business that does not keep accurate records is more susceptible to financial fraud. Employees may be able to steal money from the business, and it may be difficult to detect. This can lead to a loss of confidence in the business and may even result in legal action.

Conclusion

Bad bookkeeping is a serious issue which should be avoided at all costs. It can lead to poor decisions, financial fraud, legal issues, and a loss of confidence in the business.

To prevent these problems, it’s important to have systems in place for accurate record keeping. This includes regular financial audits, strict internal controls, and a commitment to keeping accurate records at all times.

By avoiding bad bookkeeping, businesses can improve their chances of success and longevity.

Thanks for your article. I agree, effective bookkeeping is essential for the success of any business. We use xero software system which gives us the financial information to make informed business decisions. However, we might consider outsourcing our bookkeeping to you guys so we can focus on other things.