New users with Xero often make some common Xero mistakes. They can lead to inefficiencies, errors, and even regulatory penalties.

Xero is a powerful and versatile tool to help manage your business accounting. It includes modules that will simplify our bookkeeping, reporting, and compliance.

However, like any accounting software, it needs to be set up properly. It needs to be used consistently to ensure it delivers accurate and useful insights.

Fortunately, by understanding and addressing these common Xero mistakes, you quickly harness Xero’s potential. You’ll set your business up for success.

Here are eight common Xero mistakes to avoid.

1. Not Linking All Bank and Credit Card Accounts

Failing to link all of your business’ bank and credit card accounts is like trying to complete a jigsaw puzzle with missing pieces. Just like the puzzle with missing pieces, you’ll not see the whole image.

Unlinked accounts leave gaps in your financial records. This will make it harder for you to evaluate your business’ financial performance.

For example, if a credit card you frequently use for business purchases isn’t linked, those expenses won’t appear in your reports. This could lead to underreporting costs, overestimating profits, and won’t reflect your business’ true financial performance.

Unlinked bank and credit card accounts are like missing puzzle pieces – leaving gaps in your financial data and business performance insights.

Link the accounts you use for business expenses. Keep your personal and business separate. This will not only simplify tax time but also provides a more accurate snapshot of your business’ performance.

Don’t forget to periodically review connected accounts to ensure everything is functioning properly. Unlinked or outdated connections can create gaps in your data.

2. Neglecting Regular Bank Reconciliations

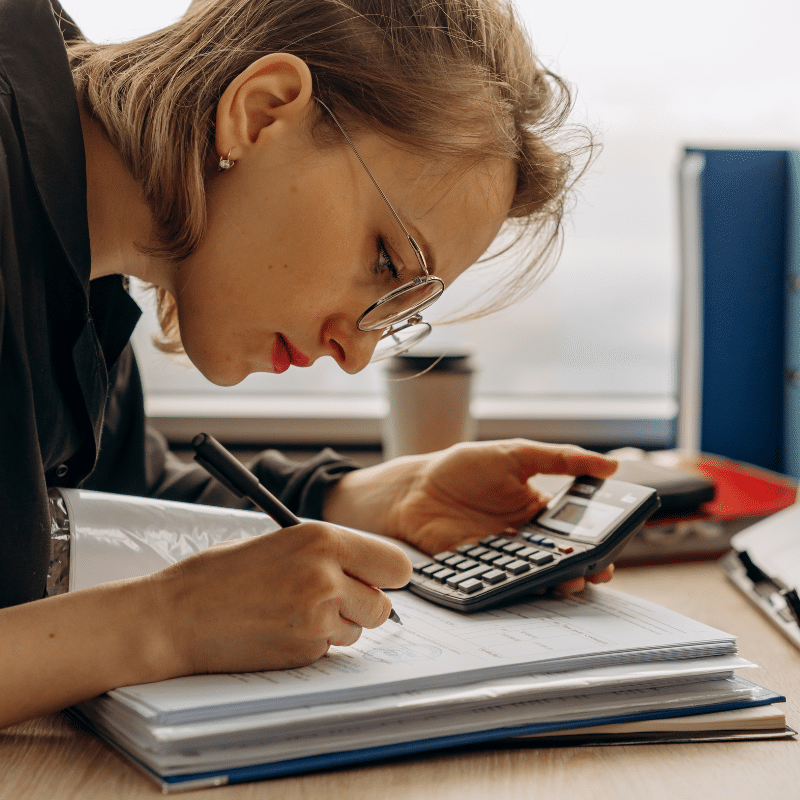

Bank reconciliations are the cornerstone of accurate bookkeeping. This is one of the most common Xero mistakes we see as many business owners neglect to do them.

A bank reconciliation involves comparing transactions in Xero to your actual bank statements. This will help you identify errors, catch entries, or spot unauthorised transactions before they become they become major problems.

Dedicate time to reconciling your accounts. Xero has tools, including automatic matching, coding suggestions which will streamline processes and help avoid manual errors.

Schedule reminders in Xero or your calendar to stay consistent. Falling behind on reconciliations can make catching up more time-consuming.

3. Granting Improper User Access

Managing user access in Xero helps protect your sensitive financial data. Assigning full access to every user can increase risks of accidental errors or unauthorised changes. Particularly if roles and responsibilities are unclear.

Grant access and permission privileges based on a person’s role and responsibility. Xero allows you to create user-specific permissions, ensuring team members only access the features you grant them.

Regularly audit your user permissions – especially when a staff member resigns. Failing to revoke their access can leave your data vulnerable.

4. Lack of Financial Standard Operating Procedures (SOPs)

Many businesses underestimate the value of consistent workflows. Without clear SOPs, financial tasks like managing invoices, handling overdue payments, or running reports can become disorganised, leading to errors and delays.

Consistent procedures help reduce mistakes and improve efficiency, particularly as your team grows. Develop step-by-step guides for regular financial tasks and assign responsibilities to specific team members. This will help ensure accountability and consistency across the board.

Review your SOPs annually to adapt to any changes in your business or Xero features.

5. Mixing Personal and Business Expenses (a.k.a The Most Common Xero Mistake)

It’s common to use personal funds for business expenses. But mishandling these transactions in Xero can result in incomplete or inaccurate records, potentially causing tax and reporting inaccuracies.

Not recording or tracking personal payments can lead to missed deductions or inaccurate profit calculations.

Use Xero’s expense claims feature to track and categorise personal payments correctly. This will help keep your financial records tidier and help ensure you can reimburse yourself or record the expense properly.

Set a policy for handling such transactions to minimise confusion, especially as your team grows.

RELATED ARTICLE: Avoid These 5 Common Accounting Errors

6. Overlooking Tax Settings and GST or VAT Compliance

Your tax settings in Xero must be configured correctly to ensure accurate financial reporting and compliance. Many users fail to review these settings, leading to errors when filing their tax returns.

These errors can result in penalties, tax audits, and unnecessary stress during filing season.

Accurate tax settings and GST compliance are crucial for avoiding costly errors and penalties in Xero.

Regularly review your tax codes. If you’re uncertain, seek advice from a tax professional or Xero-certified advisor.

Schedule reminders to review and update tax settings or whenever tax rates change.

7. Using the Default Chart of Accounts

Xero provides a default chart of accounts. But relying on it without customising it can make your financial reports less relevant for you and your business.

A well-organised chart of accounts helps ensure your financial data is categorised correctly. It will provide better insights into how your business is performing.

Customise your chart of accounts to match your business’ unique operations. Add specific categories for expenses and income that align with your goals and reporting needs.

Work with your accountant to set up a chart of accounts that simplifies tax preparation and financial analysis.

8. Failing to Use Xero’s Automation Features

Xero offers several tools to automate processes to save time and reduce human error. Yet many users fail to take full advantage of them.

Automating repetitive tasks, like sending invoice reminders or recording recurring transactions, frees up time. It also reduces the risk of manual errors.

Explore features like recurring invoices, automatic bank feeds, and payment reminders to streamline your workflow.

Monitor automated processes periodically to ensure they’re running correctly and adjust settings as needed.

How to Avoid These Common Xero Mistakes

Managing your Xero accounts effectively doesn’t have to be overwhelming. By dedicating time to properly set it up, undertaking regular reviews, and leveraging automation tools, you can exploit Xero’s capabilities.

Want to Do It Yourself? Great! I hope these tips help and you take full advantage of Xero’s support resources.

Need a Helping Hand? We’re only happy to assist you avoid these common Xero mistakes. At Chakra Partners, our Xero-certified experts specialise in setting up and optimising new Xero accounts. We’ve helped hundreds of businesses save time, reduce errors – allowing them to focus on growth.

👉 Contact us today to learn how we can make Xero work harder for you and help your business thrive.