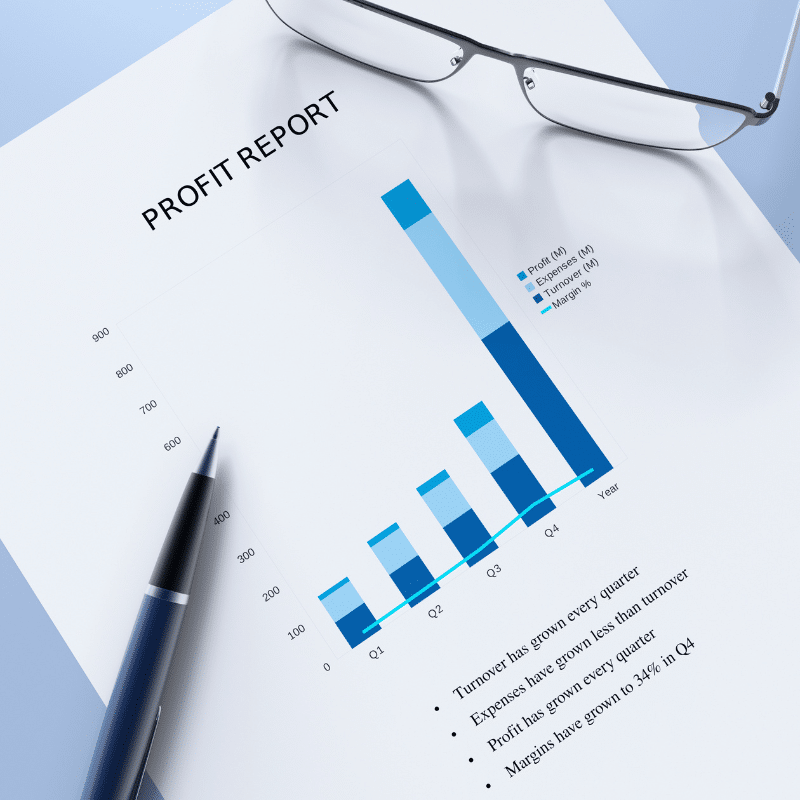

Ever wonder if your business is truly profitable? Understanding how to read a Profit and Loss report (also called an Income Statement) holds the answers!

Whether you are looking to attract investors, make smarter decisions, or simply understand your financial health, this report is your key tool for success.

WHAT IS A PROFIT AND LOSS REPORT?

When learning how to read a Profit and Loss report, you will discover it breaks down your business’ income and expenses over a specific period. It will show you exactly where your money is coming from and where it is going.

It is not just about profits. It is about understanding whether your business is thriving or needs adjustments to get on the right track. For instance, a small retail business might use a P&L report to see that its monthly sales are strong. But high rent is eating into profits, prompting the owner to consider moving to a more affordable location.

WHY IT MATTERS TO YOUR BUSINESS

Learning how to read a Profit and Loss report is much more than just crunching numbers. It is a roadmap that helps you:

Make Informed Decisions

Understanding your Profit and Loss report helps you identify trends and make decisions like adjusting staffing during slower periods. A restaurant owner might notice from the report that lunch sales are consistently lower than dinner. This prompts them to launch a lunchtime promotion or reduce staffing during those hours.

Attract Investors and Lenders

When seeking funding, knowing how to read a Profit and Loss report shows potential investors your business’s profitability. For instance, a tech start-up might show steady revenue growth in their P&L. This might demonstrate their business model’s success, increasing their chances of securing investor funding.

Improve Internal Insights

By learning how to read a Profit and Loss report, you can optimise business operations. A manufacturing company, for example, might notice that one product line is generating most of the profit, while others are under-performing. Consequently, they decide to shift focus and resources toward the more successful product.

Plan for Tax and Financial Obligations:

Knowing how to read a Profit and Loss report can simplify tax season. A freelance graphic designer, for example, can use the report to calculate their total taxable income. Furthermore, they scrutinise it to identify deductible expenses like office supplies, software subscriptions, or travel costs.

KEY SECTIONS OF A PROFIT AND LOSS REPORT

Let us break down how to read a Profit and Loss report by understanding its key components:

Sales/Revenue

When looking at a Profit and Loss report, you will see this section shows all income generated from your core business activities. For example, a software company might have subscription fees and one-time purchases listed under this section as its primary revenue sources.

Other Income

Understanding how to read a Profit and Loss report will highlight earnings outside your core operations. Such as selling unused equipment or receiving interest from a business savings account. A retail store that sells old inventory or fixtures might list that revenue here.

Cost of Sales (Direct Costs)

As you read a Profit and Loss report, you will identify expenses directly tied to producing your products, like materials and labour. For example, a bakery would list the costs of flour, sugar, and baking supplies here.

Gross Profit

A vital part of knowing how to read a Profit and Loss report is understanding gross profit, which is sales minus the cost of sales. A retail store might calculate that it made $10,000 in sales. After deducting $4,000 for the cost of goods sold, it has a gross profit of $6,000.

Overheads (Operating Expenses)

In your Profit and Loss report, overheads represent your ongoing business costs. Examples include rent, utilities, and salaries. For instance, a consulting firm might list office rent, internet, and administrative staff salaries in this section.

Net Profit/Loss

Finally, knowing how to read a Profit and Loss report lets you see whether your business is truly profitable after all expenses. For instance, a marketing agency might see $200,000 in revenue and $150,000 in expenses, leaving a net profit of $50,000.

>> RELATED ARTICLE: Avoid these five common accounting errors

HOW TO USE YOUR P&L REPORT

When you have mastered how to read a Profit and Loss report, you can use it to:

Evaluate Performance

Understanding your Profit and Loss report lets you identify where your profits are coming from and where you are losing money. For example, a retail store might notice high sales but low net profits. Subsequently, the owners take a closer look at overhead costs such as high rent or labour costs that are eating into margins..

Spot Growth Opportunities

Learning how to read a Profit and Loss report helps you recognise trends in your revenue and costs, guiding smarter growth strategies. A fitness centre might notice that its weekend classes bring in more income than weekday sessions. So they decide to offer more weekend classes or increase marketing for those slots.

Refine Your Strategy

For example, by knowing how to read a Profit and Loss report, you can decide to reduce investment in products with low margins. Instead, you can focus on high performers. A furniture store may see that sofas generate more profit than dining tables and choose to promote that product more.

Attract Investors or Secure Loans

Investors want clarity. Knowing how to interpret your Profit and Loss report will allow you to confidently show your financial performance and future potential. For example, a local bakery looking to expand might use their report to show consistent sales growth and profitability. Thus making them a more attractive prospect to lenders.

Forecast the Future

Once you understand how to read a Profit and Loss report, you can use past data to forecast future profits and expenses. This will help , ensure better cash flow management.

For instance, a seasonal business such as a holiday decoration store might use P&L data from previous years to predict slower months. They can then use this information to plan accordingly.

Tax Planning and Compliance

Mastering your Profit and Loss report will better prepare you to maximise your tax deductions. For example, a freelance photographer uses the report to track expenses like equipment purchases, travel, and software subscriptions. This helps them ensure they maximise tax deductions.

PRACTICAL SUGGESTION

Pay special attention to “Other Income” and “Other Expenses.” These often reveal hidden sources of profit or loss. For example, you run a restaurant and notice that renting out your space for private events generates significant “Other Income”. Consequently, you consider doing it more often to help boost your bottom line.

TAKE CONTROL OF YOUR BUSINESS FINANCES

Learning how to read a Profit and Loss report is your ultimate tool for making data-driven decisions. Consequently, it help ensure your business’ long-term financial health. Whether you are fine-tuning your business strategy or preparing for growth, this report gives you insights you need.

Ready to dive deeper into your business’ financial health?

Contact us today for a detailed guide on how to read a Profit and Loss report tailored to your business needs. Let us help ensure your financial success together!